Photo by Anne Nygård on Unsplash

Data has become a vital commodity in today’s market. The same is valid for the semiconductor industry. More so when the cost to capture the semiconductor data is rising. The semiconductor data capturing is directly tied to the process level solution that demands high-cost LAB and FAB to enable data collection to make accurate decisions.

Rock’s Law (Moore’s Second Law) states that the cost of building a semiconductor manufacturing facility doubles every four years. However, in the last few years (market dynamics), Rock’s Law is not only changing in terms of cost but also time.

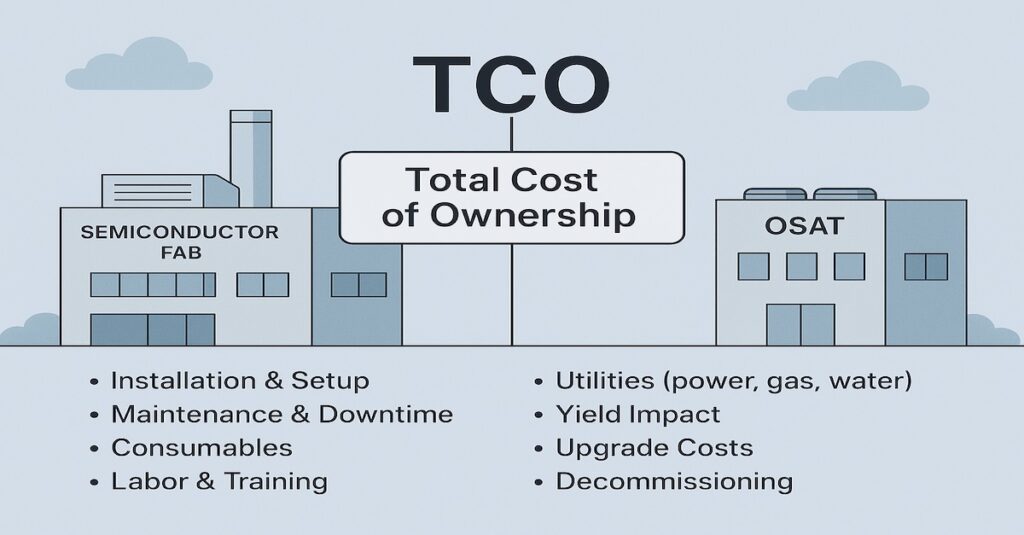

Today, the cost doubles every two years (or even less). It is primarily due to the faster advancement in the technological solution that is creating the need for next-gen equipment and processing tools. All of this implies that the total cost of manufacturing is increasing.

Escapes: Capturing relevant semiconductor data prevents design to manufacturing escapes.

Cost: Mitigating cost by capturing issues before they occur demands accurate use of semiconductor data.

As the cost of manufacturing increases, so does the cost of generating the data out of silicon. Without semiconductor data, escapes get introduced during the manufacturing phase, and if an escape does occur, it can add unnecessary costs.

Semiconductor data accuracy becomes more relevant when the silicon can be active in the field for a very long time (years to decades). Any failure can then have a catastrophic impact on the customer and eventually impacts overall product quality.

While the cost to generate the silicon data to enable next-gen devices is increasing. On another side, it is also vital to keep investing in tools to drive data-driven semiconductor product development.

Semiconductor data also plays a crucial role in enabling planning while driving quality products. Planning aspects come into the picture when the process of die-level data is collected to dive into futuristic device development. Without the semiconductor data, the designers and manufacturers cannot plan the roadmap for next-gen devices to improve the performance and the quality of the products.

Data via simulation is helpful up to a certain extent. For long-term manufacturing investments, short-term investment is required to enable the validation of silicon products. And doing so requires investing in LABs to capture relevant silicon data, which is a time and cost-demanding process.

Quality: Semiconductor data empowers designers and manufacturers to provide high-quality products.

Planning: Semiconductor data is also important to enable next-gen design and manufacturing processes.

The semiconductor industry is planning for the world beyond 2nm, and implementing such plans demands silicon data that can prove the solutions work out in reality. On paper (via simulations), the planning can only go out to a certain extent, beyond which companies need to drive validation via CapEx.

The semiconductor data is getting costlier. However, semiconductor companies still have to keep investing to capture relevant data to mitigate escapes. On top, data enables quality products and robust (technical and business) planning. If semiconductor companies are planning for manufacturing capacity, then they should always account for the semiconductor data cost and its positive impact.