Photo by Firdouss Ross on Unsplash

THE REASONS FOR THE OVERLAPPING OF SEMICONDUCTOR PURE-PLAY FAB AND OSAT BUSINESS

Semiconductor manufacturing is heavily dependent on external vendors. This is more true for semiconductor companies that do not have any internal manufacturing capability and have to rely heavily on outsourcing.

This has made Pure-Play FAB and OSAT the two major driving forces of semiconductor manufacturing. It is widely known that FAB-LESS (and OSAT-LESS) semiconductor companies have contributed heavily in driving the external Pure-Play FAB and OSAT business.

There are few widely know accepted business model that defines the semiconductor design and manufacturing:

FAB-LESS: Semiconductor companies that only focus on semiconductor design and rely on external Pure-Play FAB and OSAT for semiconductor manufacturing.

IDM: Semiconductor companies that focus on both semiconductor design and manufacturing and have the internal capacity to execute both and also take help of external capacity when required.

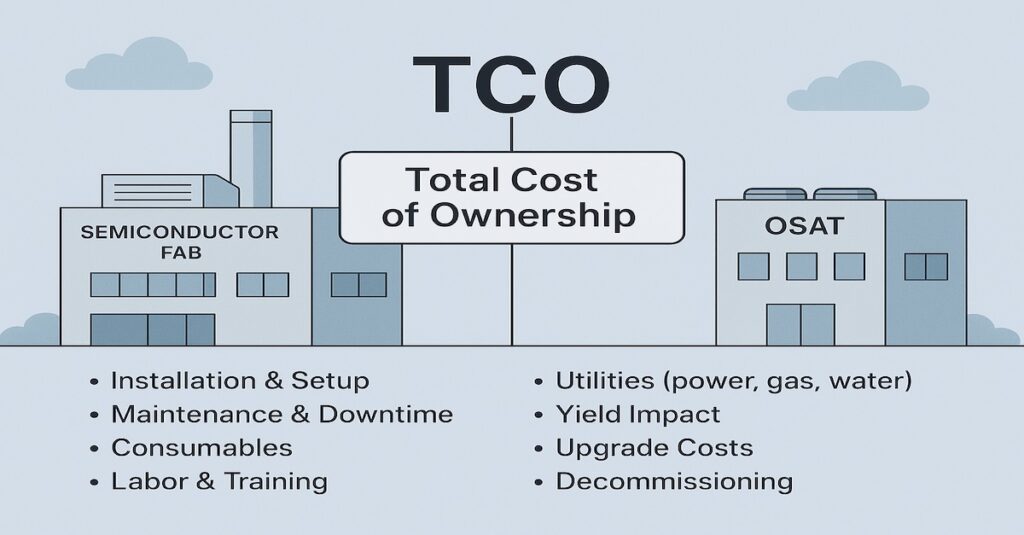

Pure-Play FAB: Semiconductor companies that invest mainly in semiconductor fabrication capacity. Cater to both FAB-LESS and IDM.

OSAT: Outsourced semiconductor assembly and test business that caters to any semiconductor companies without internal assembly and testing capacity.

The above definitions were applicable in the 1980s and 1990s, and to some extent till the 2000s. However, as the reliance on the semiconductor industry has grown, so has the application of the above business models. This is at least true for Pure-Play FABs and OSATs because of the following reasons:

Opportunity: Both Pure-Play FABs (more than OSATs) and OSATs are seeing the growing importance of providing extensive services than only specific ones. This is pushing them towards each other’s market. Some of the big Pure-Play FABs already have internal assembly and testing facilities and are already capturing OSAT business. Few Pure-Play FABs are also forming JVs with external houses to provide OSAT services like an umbrella business. This is putting pressure on OSATs and slowly they have also started exploring opportunities beyond OSAT business itself.

Services: In the end, both Pure-Play FABs and OSATs are providing services to their customers. The more and the better services they can provide the larger market they can capture. Increasing portfolio and moving beyond dedicated services is another reason why Pure-Play FABs and OSATs are entering each other’s business market.

Technologies: Top Pure-Play FABs are already known for providing 2.5D/3D packaging expertise. This is mainly due to More-Than-Moore solutions the semiconductor world is looking forward to. This is naturally allowing Pure-Play FABs to increase back-end business, and thus putting pressure on OSAT to innovate its back-end solutions or provide Pure-Play FAB services to even out the market.

Resources: Both Pure-Play FABs and OSATs can drive new technological solutions from inception to production. The major factors are the internal resources (equipment, labs, facilities, etc.) and also a talented pool of researchers who can execute the new solutions on the go. This is another major reason why Pure-Play FABs and OSATs are looking at each other’s market and slowly rolling out new services.

New Model: The high cost to develop large FAB and OSAT to only provide one set of services is raising the question as to whether there is an opportunity to extend the same facility to drive new services. This eventually means providing overlapping services and thus enabling a new semiconductor business model.

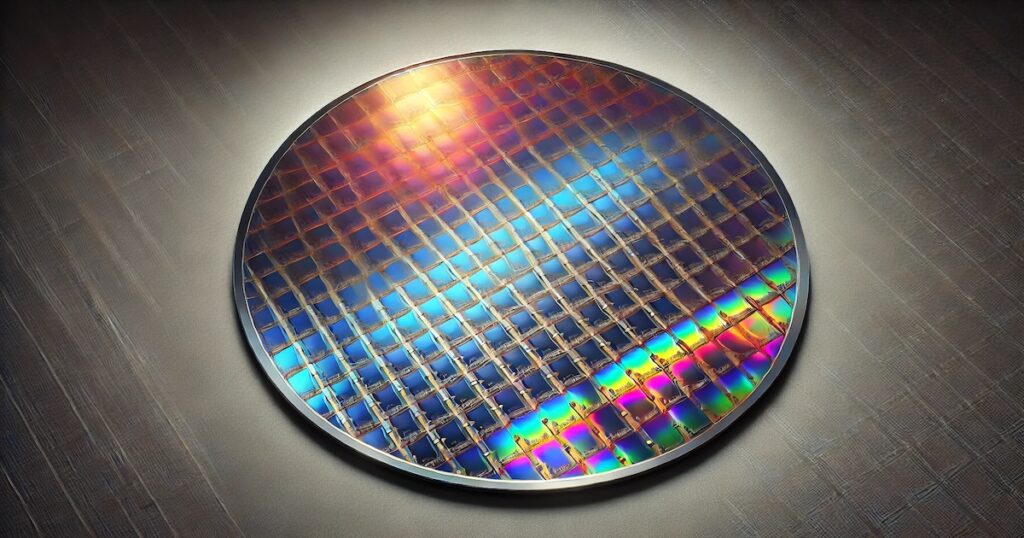

Pure-Play FAB business started with the focus of providing big giant factories that can take design files and bring them to reality in form of silicon wafers. However, semiconductor fabrication is only one part (important though) of the semiconductor product development. Pre-fabrication and post-fabrication activities are also critical and Pure-Play FABs are realizing the importance of it, and to fill this gap, in the last few years Pure-Play FABs have started investing in assembly and testing services (design is not far behind). While this makes them essentially an Integrated Device Manufacturer (IDM), however, the percentage of assembly and testing services that Pure-Play FABs provides is still comparatively less but certainly on the rise.

OSAT business on other hand has primarily focused on assembly and testing, and it has allowed them to build high-class facilities that can test and package the product as per the customer requirements. However, as Pure-Play FABs start getting into the assembly and testing services, the OSAT business is changing itself to extend services beyond assembly and testing. Top OSATs are looking to invest in smaller FABs that can allow them to capture the fabrication market, and some OSATs have already created subsidiaries that focus on the design aspect of semiconductor product development. Thus also colluding with the FAB-LESS business model.

The overlapping of Pure-Play FAB and OSAT business is raising questions as to whether there even exists a specific semiconductor business model, and what are the long-term implications.

THE IMPLICATION OF MERGING SEMICONDUCTOR PURE-PLAY FAB AND OSAT BUSINESS

Semiconductor manufacturing companies expanding their business to provide more services is certainly a welcome move, but the implications of doing so can be both positive and negative. More so when Pure-Play FABs and OSATs extend their services and start capturing each other’s market.

For semiconductor customers (mainly FAB-LESS) having more options to outsource semiconductor manufacturing will be positive news only. However, only a handful of Pure-Play FAB is capable of capturing OSAT business, and this will certainly raise the level of dependence on big manufacturing giants which might not have positive implications in the long run.

This is why it is important to understand what are the major implications when Pure-Play FABs starts getting into the OSAT market and vice verse:

Competition: Overlapping of Pure-Play FABs and OSATs will increase the competition to provide semiconductor fabrication, testing, and assembly services. For customers hiring Pure-Play FAB and OSAT, it is a win-win situation and so will it be for the semiconductor industry at large as there will be more capacity and also options for outsourcing to semiconductor fabrication and back end services.

Dependence: If more semiconductor companies start providing fabrication to the assembly under one roof, then it will slowly make FAB-LESS more dependent (than today) on specific solutions providers. The major reason is due to the notion of keeping all semiconductor manufacturing under one location/flow so that the cycle time reduces. Hiring two different vendors brings more complexity than hiring a single vendor which can perform all the semiconductor manufacturing services at the same location.

Cost: If all the semiconductor manufacturing (fabrication, testing, and assembly) services are provided by a single entity, then it can allow semiconductor design companies to lower the cost by negotiating the terms. It might also be the case that the cost of development goes up due to new facilities requiring the full cycle of qualification before it can be used to fabrication, test, and assembly the silicon products.

Capacity: If Pure-Play FABs and OSATs ramp up their efforts to enter the new semiconductor manufacturing business, then it will bring new capacity for the semiconductor industry. In the long run, this can have a more positive impact and can certainly mitigate future semiconductor shortages.

Emerging Solutions: Extending business to provide new services often leads to innovation. This can very well happen if OSATs start exploring the fabrication business and drive newer technological solutions that are not only limited to technology nodes but are also about new semiconductor manufacturing methodologies. The same can be true for Pure-Play FABs.

The overlapping of Pure-Play FABs and OSATs is inevitable. One of the strategies that Pure-Play FABs and OSATs can deploy is to invest in smaller OSATs and FABs respectively. This can remove the risk of investing a large sum of money on upgrading existing facilities and can also bring life to smaller OSATs/FABs which are on the verge of closure.

In the end, if OSAT and Pure-Play FABs keeping increasing their foothold into each other’s arena, apart from trying hands on the semiconductor design (dominated by FAB-LESS and IDMs), then does that mean all OSAT and Pure-Play FABs will turn into IDMs and eventually there will be no dedicated OSAT and Pure-Pay FABs? Only time can answer this question.