Photo by Laura Ockel on Unsplash

THE REASON WHY COUNTRIES ARE PUSHING IN-COUNTRY SEMICONDUCTOR GROWTH

The basic and the applied science form the base for any technological advancement. Countries globally have always focused on the importance of these two aspects of science. That is why countries race against each other and invest a lot of time and money to lead science that enables technology.

In the 21st century, the focus on applied science (basic science is not behind, maybe ahead in several aspects) skyrocketed due to the proliferation of digital devices and wireless connectivity. Only a handful of countries quickly realized the importance of leading in a technological solutions that forms that base of a modern digital solution. Some focused heavily on the research and development (design) of novel technologies (WiFi to 5G to autonomous to robotics and beyond), while others emphasized the need to manufacture these for the end customers.

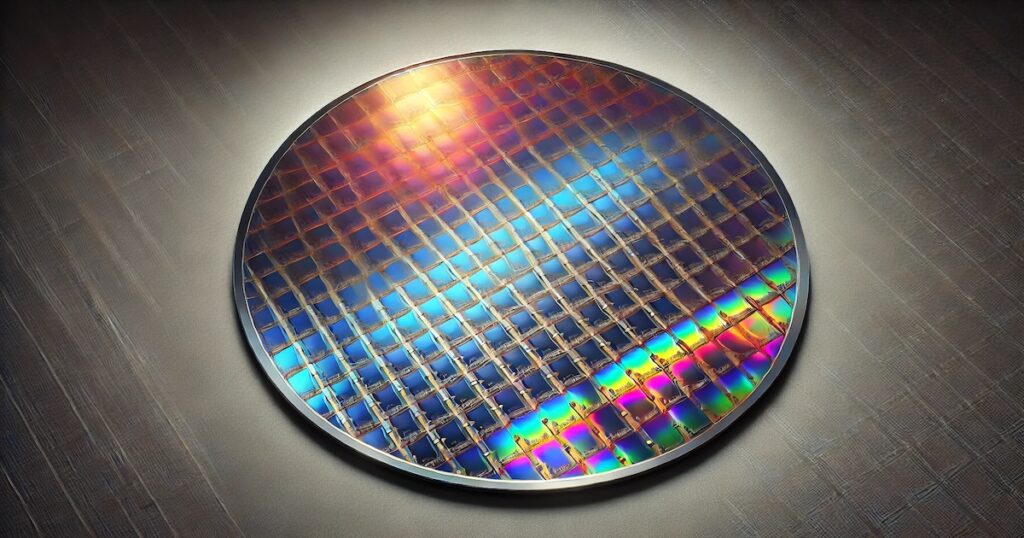

Semiconductors Are Everywhere

The semiconductor industry also can be seen by separating out into design and manufacturing. Countries like the USA focused more on the design aspect of the semiconductor, while Taiwan and China ramped up manufacturing efforts. This worked well until the 5G and COVID raised concerns over the growing inter-dependency, and then started the saga of how leadership in the semiconductor design and manufacturing affects day-to-day technological (from satellites to cars) solutions. This in turn started pushing several other countries (India to Australia and beyond) to focus on the need to design and manufacture semiconductors in-country.

There are several reasons as to why countries (which are behind) should focus on end-to-end in-country semiconductor industry (or at least have enough infrastructure to cater to in-country demand):

Dependency: Relying on other regions for manufacturing or designing semiconductor products is one reason that is pushing countries to focus on the in-country end-to-end semiconductor solutions. This also includes materials to equipment. It is difficult to make everything in-house, hence good enough infrastructure to cater to the local consumer demand and critical national infrastructure of the county is a good way to start.

Import-Export: From smartphones to cars, all are heavily powered by semiconductor solutions. In trade, it is good to keep imports and exports in balance. Countries without vital semiconductor (manufacturing) infrastructure will always end up importing more than exporting. This will put pressure on their forex reserves and will make them fully dependent.

Growth: The semiconductor market is growing due to the growth of semiconductor usage in the modern infrastructure/technology. Automotive is one example, apart from the consumer market, and many other industries where semiconductor solutions are used by default. Countries should capture a portion of the market which will eventually generate employment and business growth. This is critical for long-term financial stability too.

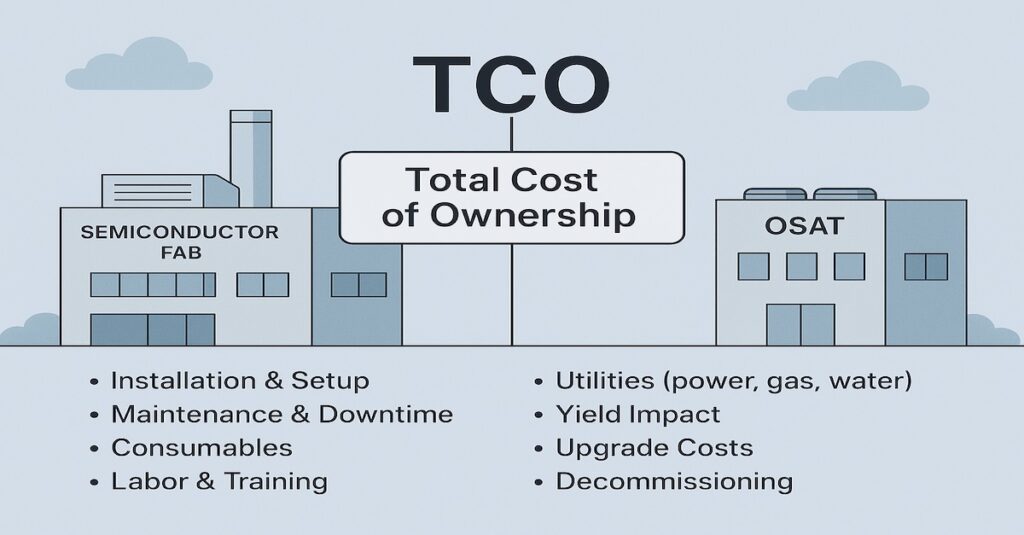

Business: Establishing a high-tech industry like semiconductors (mainly manufacturing, as many countries do have design houses) will not only lead to market growth and employment but will also support other businesses that eventually are the pillars for the semiconductor industry. It can be from equipment manufacturing to raw materials to turn-key (and ever-expanding) civil engineering work to build FABs/OSATs.

Above points fueled with the growing use of semiconductor in all the major infrastructures and technological solutions (that affects every aspect of day-to-day life) is more than enough reasons for countries with lacking semiconductor manufacturing infrastructure to start today for tomorrow’s need.

THE ROADMAP FOR IN-COUNTRY SEMICONDUCTOR INDUSTRY SUCCESS

There are 195 countries and each one of these have their own strengths and weaknesses. It is difficult to create an end-to-end in-house solutions for the semiconductor industry. More so, when the goal is to drive in-country semiconductor growth to the next level.

In reality, there are no roadmaps that countries can follow to gain momentum for an in-country semiconductor to make themselves self-reliant. On other hand, countries today also cannot overlook the importance of having as many points checked from the roadmap that can enable, if not end-to-end, some parts of the semiconductor supply chain. This will allow them to tap into the future market needs and ensure stability in semiconductor market.

The roadmap to success in the semiconductor industry consists of many points and below are the few major ones:

Talent: Nothing can be developed without having the right set of talent (human resources). Countries already have a framework to educate their population. However, the traditional education system is still focusing on core aspects that enable basic training. While there is no harm in doing so, it is about time that countries wanting to engage in in-country semiconductor growth (manufacturing and beyond), needs to start with training programs that focus more on core semiconductor on-field training programs apart from the fundamentals.

Policy: Eventually, investment is a big part of semiconductor growth. While countries looking to steer ahead in the in-country semiconductor solutions have already started to come up with incentives and policies, the approach should be more holistic that focuses not only on the semiconductor growth but also on the regional infrastructure required for the semiconductors. This may be from ensuring airports to logistics to man-power availability, apart from ease of the land and housing facilities.

Infrastructure: The semiconductor supply chain is heavily driven by the turn-key infrastructure. From FAB-LESS to FABs to OSATs, all require support infrastructure to ensure the products reach the market in time. This infrastructure varies from material handling to chemicals transportation to water availability to non-stop electricity. Building FAB/OSAT is one thing and running it non-stop is another. The better the support infrastructure for the semiconductor industry, the more likelihood of semiconductor giants willing to setup future-focused manufacturing setups.

Public-Private: Government support plays a very key role in driving in-country semiconductor growth. This can be from investing in the required infrastructure to providing incentives that can ensure required investment is available to drive manufacturing facilities. A two-way shake hand between the private players and public bodies can drive the needed policies that are friendly to both the businesses and the consumers.

Research: Research is key to long-term semiconductor growth. Countries focusing on the in-country semiconductor ecosystem should provide research funding (mainly countries with lack research funding support) to universities and colleges to focus on the next-gen semiconductor devices and manufacturing solutions. Universities and colleges themselves also can raise funding via industry collaboration with the semiconductor companies.

Academia: Education is vital to every aspect of industrialization. The majority of the countries already have the infrastructure to educate the future workforce. However, the goal to make semiconductor in-country growth requires academic institutes to focus on semiconductor engineering courses apart from the traditional engineering domains.

Cluster: FAB requires billions of dollars before it can run at full capacity and then it takes years to break even. Even then, due to changing technology-node and solutions around it, the process to upgrade FAB is a continuous one. Countries without a FAB wanting to attract/setup one, should focus more on the cluster approach. Cluster-based FAB can be a pooled investment for higher technology-node (older but relevant) that caters to different semiconductor FAB-LESS companies. Such kickstart can then lay the foundation of dedicated sub-10nm foundries.

Outreach: Outreach is about reaching out to other countries and also attracting businesses to showcase what a specific country can offer. This way there is a dialog between the public and private players that can lead to many business opportunities in the semiconductor sector. Countries should do outreach by default, if the goal is to setup the semiconductor manufacturing (FABs to OSATs) in-country.

Future-Tech: Countries that have semiconductor design houses but not manufacturing facilities should set the target on what the world will need in 2040 and not in 2030. This can range from chiplets manufacturing (semiconductor specific) to next-gen 6G wireless solutions to flexible electronics. Doing so will ensure that the companies and countries are creating infrastructure today for tomorrow’s demand. This can give an edge over countries with massive semiconductor manufacturing infrastructure and are not willing to invest further without closing/upgrading existing semiconductor infrastructure.

The above roadmap points cover the majority of the aspect of ensuring in-country success in the semiconductor industry. There can be different points that also are vital for the semiconductor industry growth. In the end, it all boils down to what eventually works and what does not.

THE LONG TERM IMPACT OF IN-COUNTRY SEMICONDUCTOR INDUSTRY

The last two years have shown the growing importance and emphasis on the need for in-country semiconductor industry growth. Countries are putting efforts to lead in every aspect of the semiconductor solutions, mainly in order to make themselves less reliant on other countries while also taking lead in the advanced modern technological solutions.

The in-country semiconductor growth will have two major long term impact:

Self-Reliance: Countries that can take the lead in the semiconductor industry growth will make themselves self-reliant in the long term. Which will prove vital in the long term due to the fact that the consumers solutions to national infrastructure is fully reliant on the semiconductor powered solutions.

Leadership: There is no denying that every country is racing to claim leadership in every aspect of the modern world. Leadership in the semiconductor industry is certainly going to veto on who gets to call itself the superpower.

It is good that the semiconductor industry is getting the focus, but countries will have to be diligent in understanding what works and what does not works as per the demand and supply requirements.

In the end, investment to get semiconductor manufacturing up and running is huge. Any miss-step will put countries behind instead of going ahead. It also takes years of planning to create any kind of massive (and advanced) infrastructure.

Hopefully, the global supply chain the semiconductor industry runs on, stays intact even with in-country semiconductor infrastructure race.