Photo by Lenny Kuhne on Unsplash

THE IMPACT OF SEMICONDUCTOR SHORTAGE ON AUTOMOTIVE INDUSTRY

Automotive is one of the several industries that heavily rely on semiconductor products to provide different features. These features range from infotainment to sensors to wireless communication. Over the last few decades, the need to drive such advanced features has increased the share of semiconductor products in automotive manufacturing.

Due to the heavy dependence on automotive semiconductor products, the automotive industry has also been impacted because of the semiconductor shortage. The non-availability of the automotive semiconductor product has certainly brought several challenges for the automakers (and OEMs) and worldwide automakers are now struggling to keep their production line up and running.

In the end, automakers also have to rely on OEMs to provide the sub-systems that their production line uses. The delay is more because the OEMs are not able to procure the silicon chips (from OSATs and FABs) required to provide the end systems that automakers use to assemble different vehicles. Eventually, the impact is felt on the end product (vehicles) and this is why the focus has shifted more on automakers than the OEMs.

Below are the major impacts of the automotive semiconductor shortages on the automotive industry:

Delay: Semiconductor capacity crunch has lead to a shortage of critical automotive semiconductor products. Automakers are not able to ship or sell vehicles without these vital silicon chips. This has lead to a backlog of orders and slowly causing leading to the halt of several automotive production lines. Given how strict the quality and reliability requirements of automotive semiconductors are, it is difficult to switch the FABs and OSATs where the capacity might be available. All this is impacting automakers with severe delay in providing the last piece of silicon automakers need.

Revenue: Automaker’s OEM vendors are not able to procure the required number of silicon chips to design automotive systems that are needed by different vehicles. This has caused a supply chain gap and has impacted the revenue (slow production line) of the majority of the automakers even though the demand is high.

Human Resource: Due to the slow or halted production lines, the automotive manufacturers are taking tough decisions to lower the loss caused by the semiconductor shortage. One such decision is layoffs and unfortunately, it is leading to job losses.

Planning: Automakers worldwide launch new models and trims every year. Due to the semiconductor shortage, automakers are not able to plan out their future product launches. This is severally impacting their long-term planning and more so when it comes to launching alternate-fuel technologies to drive next-gen vehicles.

Cost: As it happens in any other industry, the slow production has to lead to a supply crunch and this is leading to a rise in the cost of vehicles. On top of this, the cost to develop new products and solutions has also gone up mainly due to the impact on timeline and schedule caused by the semiconductor shortage.

The severe impact of the automotive semiconductor shortage has prompted the automotive industry to take a serious look at the importance and share of semiconductors in automotive manufacturing.

As the world moves towards alternate-fuel technologies to drive next-gen automotive products, the share of automotive electronics (developed by the semiconductor industry) will keep increasing. This implies that any semiconductor shortage in the future will also keep impacting the automotive industry.

The corrective actions (based on semiconductor shortage) will take years of planning and investment, and it is about time that the automakers (more than the OEMs) start preparing themselves for future implications today.

THE RECIPE TO MERGE SEMICONDUCTOR INTO AUTOMOTIVE MANUFACTURING

Every industry that has been impacted by the semiconductor shortage has started preparing backup plans for the future. This is mainly true for the OEMs who could not procure the semiconductor chips required to develop their system so that their customers can use and ship the end product out of the manufacturing facilities.

When any other manufacturing industry is compared with automotive manufacturing, the major difference that stands out is the amount of investment and big plants that are required to keep assembling the new vehicles. On a positive note, the experience of handling large manufacturing facilities provides the automotive industry an edge mainly due to the vast experience in building complex machines. If planned well, there is no question that the automotive industry can easily adapt and embrace non-automotive (semiconductor) manufacturing facilities.

Automotive manufacturing is indeed heavily dependent on OEMs. More so for systems that are built using semiconductor chips and end up getting plugged during the automotive assembly process. This dependence has grown with the growing importance of semiconductor products that are required to build a more advanced automotive solution than its predecessors.

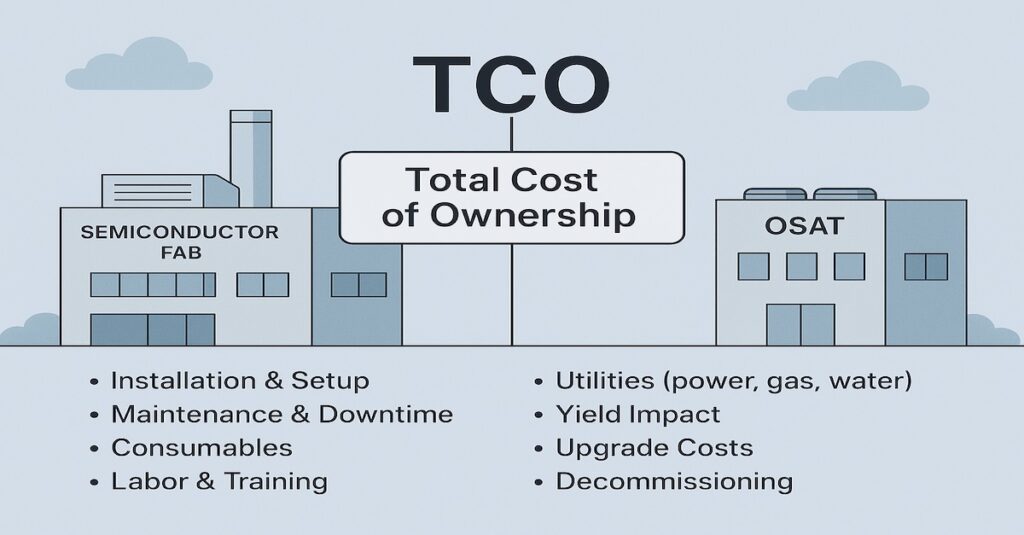

Semiconductor Design -> FAB -> OSAT -> OEM -> Automotive Manufacturing

For automotive manufacturing, if there is one important question that comes out of the semiconductor shortage saga, then it is about how to mitigate future semiconductor shortages. To answer this question, several automotive manufacturers have already started preparing plans to make themselves self-sufficient for future semiconductor needs. In reality, it will take a lot of time and effort, but such push by the automotive industry is inevitable.

Irrespective of the path taken by different automakers, the below recipe can be used to understand how to merge semiconductor manufacturing into the automotive manufacturing process:

Cluster: Setting up semiconductor manufacturing (mainly FABs and OSATs) is a big investment. It requires years of planning and then billions of dollars to execute and thereafter millions to keep the facilities active. It is a risk that few key players have taken. What the automotive industry should focus on is a cluster-based approach wherein different automakers pool money and resources to create a network of automotive-focused FAB and OSAT facilities. This can be a multi-tier JV that can drive the manufacturing of critical automotive semiconductor products. These cluster facilities can also balance out the semiconductor manufacturing capacity worldwide.

In-House Capacity: Apart from the cluster semiconductor manufacturing approach, automakers can also find avenues to build semiconductor manufacturing capacity in-house. This is certainly not easy to execute and there are only a handful of automakers that will have the kind of investment required to drive FABs and OSATs. But this is certainly the way to go because the importance of semiconductors in providing new technology features will keep increasing.

Team: Irrespective of whether the automotive manufacturers end up building their semiconductor manufacturing facilities or not, there should be a push to create a network (within and outside) of semiconductor teams that can provide insights into the design and manufacturing of next-gen semiconductor products. This can help automakers understand which target features can be optimized using a different set of available semiconductor features. This can also be a way to make automakers self-sufficient when it comes to the automotive semiconductor.

Acquisition: Automakers should start acquiring emerging companies that provide automotive semiconductor solutions. They can do so by focusing on critical automotive features like LIDAR, RADAR, CMOS cameras, sensor-based tech, and even centralized XPUs for future autonomous vehicles. In the end, these strategic acquisitions will help automotive companies drive in-house semiconductor design operations, which can slowly kickstart the need to move towards the manufacturing aspect of semiconductors, which can also be executed by acquiring small FABs and OSATs.

Investment: Even if automakers are not able to acquire semiconductor-focused emerging companies, they should start investing in semiconductor companies that can add value to their portfolio. This investment can be equally distributed towards both the design and the manufacturing aspects of the semiconductor.

When the world comes out of the semiconductor shortage (which can take anywhere from months to years), there are certainly going to be new players entering the semiconductor industry to take control of the different aspects of the semiconductor supply chain that affected their business.

One such industry will be automotive, and there is certainly going to be a push by automakers to make themselves self-sufficient to ensure that any future semiconductor shortage does not impact their production line.

The recipe to merge semiconductor manufacturing (and even design) with automotive manufacturing is readily available and the only missing links are the actions by the automakers.